Welcome to our weekly roundup of news from South America.

Mosoj ESG provides information, data and analyses relating to South America integrating Environmental, Social and Governance topics to promote sustainable development.

Bolivian Banks – where are the bad loans?

This week, we looked at the banking sector in Bolivia as several banks – with combined total assets of $32.8 billion - had released their results for year-end 2020. Our general outlook on the sector remains negative given the challenging macro-economic conditions (with a possible double-dip in Q1-2021), whilst much of the reported 2020 pain doesn’t appear fully reflected in the numbers in our opinion.

Source: Bolsa Boliviana de Valores

Indeed, we continue to believe that Bolivian banks continue to face significant downside risks in terms of worsening asset quality (loans going bad), and we look forward to the full financial statements to carry out a deeper analysis of their capital adequacy. Of note, whilst the Bolivian GDP contracted substantially in FY2020 (IMF predicted a drop of 7.9%), the banking sector’s total assets increased by ca. 11.3%.

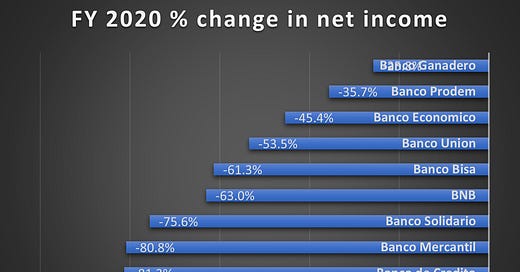

In terms of profitability, 2020 was indeed a tough year and banks generally took a big hit, with combined net income down by ca. 65%, mostly due to the fall in transactions fees and commissions, while loan loss provisioning did increase and net interest margins continued to fall.

Source: BvD - Moody’s Analytics and Bolsa Boliviana de Valores

Going forward, we expect further margin compression as a result of a difficult environment, though fees and commissions should probably bounce back strongly when economic activity returns.

This should mitigate to some extent the negative impact to the bottom line of any further provisioning for loan losses. Indeed, given the depth of the crisis, we would have expected to see a higher proportion of loan loss provisioning as a percentage of the whole loan book.

Source: BvD - Moody’s Analytics and Bolsa Boliviana de Valores

Indeed, asset quality was already deteriorating before 2020, and as many bankruptcies were announced during the course of 2020, we are left to wonder where are the losses?

What to Watch

Banks will face continued pressure on earnings driven by declining net interest margins, continued disruption in economic activity (e.g. Q1-2021) and increased provisioning.

Asset quality has deteriorated materially, and losses should materialise at some stage. This will expose banks with weaker underwriting standards, as well as those exposed to the informal and micro-sectors.

Capital adequacy is a concern for some banks, who may need capital injection if the economic disruption continues.

Social and governance risks remain substantial as we expect increased levels of corruption and/or fraud across the system.

Carnival cancellation makes country stop moving $1.5 bn

Petrobras concludes sale of BSBios and receives $47 mm

Focus Energia will invest $407 mm in photovoltaic complex

Government fails to collect $44.8 bn in debts

Volvo and Enel X announce 250 electric charging stations in Brazil

Rural Credit Programme finances agriculture and livestock with $314.8 mm in 2020

Senate authorises $200 million credit to small and medium enterprises

Organic sector grows 30% in Brazil in 2020

Aurora’s revenue grows over $740 mm

Suzano makes $1.1 bn profit in Q4

Neoenergia has net profit of $184 mm

$222 mn investment converts Ford factory into logistics centre

Cube Startups Revenue totals $815 mn in 2020, an increase of 1.52%

YPF avoids March default with 60% support for key bond swap

Guzmán: dollar to rise 25% this year to reach $ 102 in December

Argentina received more than $7 bn in investment in the last seven months

Argentina and China negotiate $30 bn investment plan

Argentina allows $120mn wind park to commence operations

Argentina approves Indian Covishield coronavirus vaccine

The top 10 private banks (o/w 5 are foreign) hold 49% of deposits

Short term deposits in Argentina increased to 82%

YPF to invest $2.7 bn to increase oil and gas production

MercadoLibre accused of unfair competition in Brazil

Projected $35.9 bn in revenue from increased soybean and corn production

Díaz & Forti files for bankruptcy over $400mn dispute with Central Bank

Spain’s Naturgy lost $420 mn in 2020, $238 mn in Argentina

Pension fund withdrawals reach $33.32 bn

Treasury identifies 85.9% of public investment projects for 2021

IMF raises projection of Chile’s GDP to 5.8% in 2021

Chile seeks to buy military equipment from US for estimated $85 mn

Exports to China exceed $27 bn

Chilean exports increase by 8% in January 2021

Agro-exports to Netherlands declined 17.5% in 2020

Central Bank recorded a net loss of $242.39 mn in 2020

Nova Royalty Corp to buy existing royalty on Chile copper project for $16 mn

Chile leads Latin America in COVID-19 vaccinations after hitting the one million mark

Flat listings for sale increased 27.4% year-on-year in 2020 while house listings fell 16.4%

Chilean fruit production facing 50% losses

Colombia’s external debt: 54,8% of GDP

Banco W issued $160 mn social bonds

$225 mn infrastructure investment in Colombia’s largest port

Colombia launches $267 mn policy for ICT

Colombia seeks to increase 1.5% of GDP with fiscal reform

AES Gener raises $306 mn to invest in renewable energy in Colombia and Chile

New public program has ensured $280 mn in sales for Colombian farmers

Colombian public pension fund reached record-high profits at $67 mn in 2020

The IMF increased Colombia’s GDP growth projections for 2020 and 2021

Small businesses employ 23 % of formal labor supply in Colombia

Up to $3,4 bn for 51,4% of shares in energy distributing company, ISA

Mutún project to be reactivated with $466mn investment, mostly from China

Bolivia signs deal with China’s Sinopharm to acquire 500.000 coronavirus vaccines

YPFB to invest $128.72 mn in household gas network

VAT collections registered annual growth of 4.3% in January

BOA cuts salaries and staff to cut costs by 30%

Bolivia inaugurates solar plant with 100 MW production capacity

Government signed agreements to promote the industrialisation of coca leaf

Bolivia to invest $5 million in a study for construction of Ichilo-Mamoré waterway

Locals seize Inti Raymi Mining Company Kori Kollo mining operation facilities and steal equipment

State to invest $ 345 mn in a zinc plant in Oruro

Carnival cancellation to cause $64 million in losses

$132.26 mn trust fund will benefit more than 100,000 agricultural producers

ABA projects insurance payout could reach $139.2 mn in 2021 due to COVID-19